Homeowners need home insurance for lots of reasons. However, the major importance of home insurance is that it protects your greatest asset – your house. This guide will assist you to comprehend the notion of home insurance and its coverage. You will also learn how to pick the ideal policy for your house and its contents.

In addition, it covers your house and your personal belongings’ needs. It even takes care of legal responsibilities that may arise, as well as the cost of relocating for a limited time period if necessary. To attain comprehensive coverage, it is essential to be aware of such particulars.

How much is covered under the policy, how much deductible has to be paid, and likely exclusions are critical to know. This guide seeks to show you the fundamentals of homeowners insurance. You will then be able to make choices that are both practical and reasonable.

Homeowners Insurance Coverage – The Fundamentals

Home insurance involves a lot of things and can be quite complex. However, the understanding of basic concepts is important especially for the home and its belongings. Broadly we will deal with insurance types, their specifics, and specific reimbursements in case things go haywire.

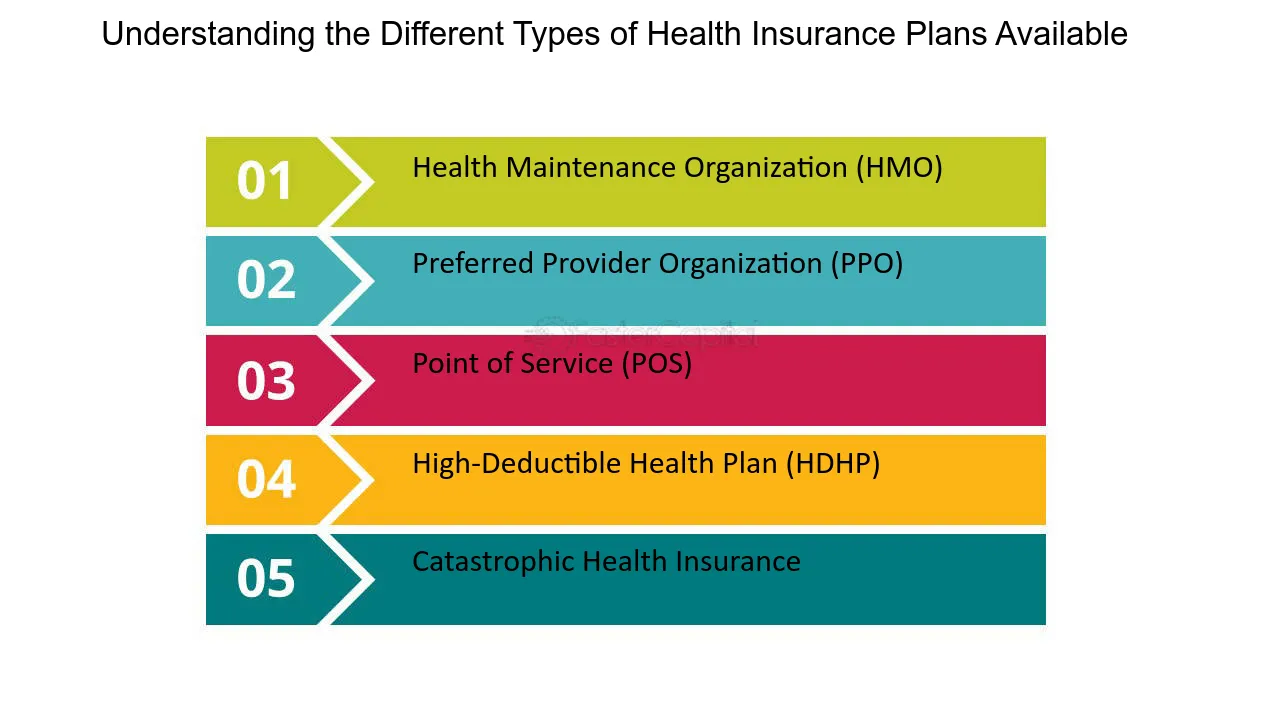

Different Variations of Home Insurance Policies

A wide selection of home insurance policies is available, and each has its own distinct purpose. Here are the most common ones:

- HO-1: Basic form, covering a limited number of named perils

- HO-2: Broad form, covering a wider range of named perils

- HO-3: Special form, the most widely used mode which covers all perils except for those specifically stated

- HO-4: Expanding the renter’s policy to include insurance for the tenant’s personal belongings

- HO-6: Covers the interior of the unit in a condominium and the personal property of the insured

- HO-8: Older home insurance which is applicable in older buildings which are not suitable for modern building codes

Essential Coverage Components

There are elements that are present in every insurance policy. These are:

Dwelling coverage: Covers the physical structure of the home.

Personal property coverage: Covers personal items like furniture or electronics.

Liability coverage: Includes legal and medical expenses where the person sustains an injury in the property.

Additional living expenses: Covers provided behind consistent housing areas and extra expenses where one’s shelter becomes uninhabitable.

Policy Limits and Deductibles

As is with other insurance policies, home insurance policies have segmentation in policy limits and deductibles. A policy limit is the maximum amount that the insurer will pay out to settle a claim. A deductible is the amount of money that an individual first pays before an insurer starts paying.

- Understanding these factors is crucial when choosing the right insurance policy for your requirements and budget.

- Dwelling coverage- protecting your house structure

- Essentially, dwelling coverage forms part of your homeowner’s insurance. It covers the physical structure of your house. Under this segment of insurance, a number of risks such as calamities and accidents get coverage. So, dwelling coverage basically helps guarantee that the pertinent home risks are insured and that one is prepared for any task.

There are several parts that make up dwelling coverage, for the purpose of listing:

Structural Repairs: If your home gets damaged by covered events like fire or wind, this coverage helps fix your home.

Rebuilding Costs: If your home is totally stripped off, this coverage helps you to rebuild your home. This consists of workmen, materials, and necessary permits for working.

Attached Structures: It also covers any structures attached to your home such as garage and deck.

In order to come up with the right level of dwelling coverage, insurance companies consider factors such as the size of the general structure, wat it was made with and the costs of construction in the relevant area. There is peace of mind that comes from knowing that one’s coverage is proportionate to the rebuilding costs.

| Coverage Type | What It Covers | Average Cost |

|---|---|---|

| Structural Repairs | Repairs to the physical structure of your home | $150,000 – $300,000 |

| Rebuilding Costs | Expenses associated with rebuilding your home | $200,000 – $500,000 |

| Attached Structures | Coverage for structures physically connected to your home | $20,000 – $50,000 |

Comprehending your dwelling coverage and ensuring it’s adequate do boost your confidence level, and Clay and Greene argue that this is the essence of a good home insurance policy.

Personal Property Protection: The Safety of Other People’s Properties

home insurance is critical in securing your property especially the teens of great value. It does not only insure your house or structure. It gives protection to your possessions from causes of loss such as theft, destruction, or natural threats.

Encompassed Personal Properties: Generally speaking, most of your insurance cover such assets as home furniture, electronic gadgets and clothing. It seems to include sporting equipment and precious stones as well. This indicates belts and jewelry for that matter.

Special Limits and Valuables: Some items, such as art or antiques may have to be insured fully. These items occasionally have restrictions on the amount your plan will cover. Personal property insurance endorsements may be necessary to ensure complete protection as a result of this.

Replacement Cost vs. Actual Cash Value: Which is better?

In the case of a claim, policyholders are given the option to collect the insured amount on replacement or current value. Replacement cost settles the purchase of new items with determined quality. Actual endorsement value settles the insured one by market pricing of such item at the moment. Decide on what you require and how much you are willing to cover your assets with.

| Coverage Option | Explanation | Advantages | Disadvantages |

|---|---|---|---|

| Replacement Cost | Covers the full cost of replacing damaged or stolen items with new ones of similar quality and functionality. | Ensures you can fully restore your belongings to their pre-loss condition. | Typically, more expensive than actual cash value coverage. |

| Actual Cash Value | Provides a payout based on the current market value of the item, taking into account depreciation. | Generally, more affordable than replacement cost coverage. | May not fully cover the cost of replacing damaged or stolen items. |

“Protecting your personal belongings is a crucial aspect of home insurance, ensuring you can recover and restore your possessions in the event of unexpected loss or damage.”

Liability Protection in Coverage of Home Insurance

Home insurance is usually viewed as protective insurance, but it does protect you from legal exposure as well. Legal exposure arises when people become injured while on your premises which results in liability insurance coverage applicable to these scenarios. Thus, it’s important for homeowners to be aware of how personal liability protection works.

Liability coverage provided under home insurance can be divided into two sub sections which are the following:

Bodily injury liability: If any person gets injured on your premises and then sues you, this component will cover the medical and legal expenses that the injured person incurs.

Property damage liability: If you break or lose someone’s property, costs required to repair or purchase new property will be covered under this component.

Your policy’s medical payments portion is also crucial. It applies to minor injuries to visitors of the property, regardless of which party caused the injury. It can cover medical bills and help avoid lawsuits.

| Coverage Type | Description | Typical Limits |

|---|---|---|

| Bodily Injury Liability | Covers legal liability and medical expenses if someone is injured on your property | $100,000 to $500,000 per occurrence |

| Property Damage Liability | Covers the cost of repairing or replacing someone else’s property if you are found legally liable | $50,000 to $300,000 per occurrence |

| Medical Payments | Pays for minor injuries to guests on your property, regardless of fault | $1,000 to $5,000 per person |

Liability protection is one of the crucial components in taking home insurance cover. It ensures that your finances are protected in case of accidental injury or even in the event of a lawsuit. It is advisable to review the liability coverage parameters because I am quite sure it’s included in your policy somewhere.

Additional Living Expenses Coverage

But if your house has to be vacated because of a fire as an example, you don’t have to panic, your insurance will take care of that. The additional living expenses (ALE) coverage is a financial insurance policy. It reimburses the temporary accommodation and additional expenses for the duration which the home is being repaired or is being constructed.

Temporary Housing Costs: Most of the time, ALE coverage will include temporary housing expenses as a requirement. A hotel rented apartment or even a campground can be all accounted under that head. It factors in the additional cost that is not the usual accommodation charge and that helps to ease the burden of being in an unfamiliar environment for an extended period.

Covered Living Expenses: Since displacement may be necessary, ALE coverage protects against many other upward living expenditures. Such costs may include the following:

- Meals and restaurant bills

- Laundry services

- Storage for personal belongings

- Transportation

- Pet boarding

However, the amount claimable as additional living expenses, additional temporary accommodation or relocation expenses, will be determined by the policy that is issued. It is always a good idea to go over your policy and check what it contains and the limits in certain areas that are covered.

| Coverage Type | Typical Limits | Considerations |

|---|---|---|

| Additional Living Expenses | 10-50% of your dwelling coverage limit | Covers the difference between normal living expenses and increased costs due to displacement |

| Temporary Housing | Actual cost of temporary housing | May include hotel stays, rented apartments, or other temporary accommodations |

| Displacement Coverage | Actual cost of increased living expenses | Reimburses for meals, laundry, storage, and other necessary expenses during displacement |

You benefit more when you understand the specifics of the additional living expense, the coverage for temporary housing and, the displacement coverage in case an insured event renders you unable to stay in the house that you occupy. It ensures that you have adequate protection when you are put out of your house due to a peril’s loss.

What Natural Disaster Coverage Is and What Exclusions It Has

The next thing that is important to note is how the coverage for natural disasters works in home insurance. Natural disaster insurance serves to mitigate the economic loss which results from hurricanes, tornadoes, and wildfires among other disasters. However, not all natural disasters fall under standard home insurance policies.

Floods are a big exception. They are not usually included in the homeowners’ standard policies. A separate flood insurance may be required by homeowners. Also, coverage extends to earthquake which is treated as an addon most times within the basic policy.

| Natural Disaster | Typical Coverage | Exclusions |

|---|---|---|

| Hurricanes | Wind damage, rain damage | Flooding |

| Tornadoes | Wind damage, hail damage | None |

| Wildfires | Damage to the home and personal property | None |

| Earthquakes | Optional coverage | Damage to the home and personal property |

| Floods | Separate flood insurance policy | Damage to the home and personal property |

Homeowners should check their insurance policies carefully. They need to know what’s covered and what’s not. They might need extra policies to fully protect their homes.

“Preparing for natural disasters is not just about protecting your home but also securing your financial future.”

Homeowners’ Comprehensive Guide to Insurance Policy Endorsements and Riders: What Are They?

Most house insurance policies have a standard range of coverages. However, there are times when a homeowner may require more coverage. This is where the endorsements or riders on the insurance policy come into play. With these add-ons, you can adjust the provisions of your policy to suit your necessities.

Common Endorsement Types

There are several common endorsement types:

Scheduled personal property coverage: This extends more coverage on valuable items such as jewelry, art, or collectibles which might have the standard policy limit on them.

Home business liability endorsement: This endorsement applies to wheeling and dealing from your home and covers liability, equipment, and other risks.

Water backup and sump pump overflow: Because these situations are rarely covered by standard homeowners’ policies, this endorsement manages risks of water damage from sewer systems or sump pump issues.

Earthquake insurance rider endorsement: This endorsement covers damages that may affect your house or items within your house if you stay in an earthquake-prone area.

Factors That Determine the Need to apply for the Additional Coverage

Applying for the additional coverage could be done at any given time which is pretty convenient. Additional coverage is needed when:

- You possess valuable items that exceed the limits set for standard coverage of personal property.

- You operate a home business or own such extensive business equipment in your residence.

- You live in a region that is susceptible to natural disasters such as earthquakes, floods, or fire.

- Specific risks delegated to the subcategories are desired to be included in the principal policy, coverage extensions are required to be selected.

Having knowledge of the insurance variants and their extensions will assist you in managing the home insurance policy. As a result, you can effectively shield yourself from the various risks that come your way.

| Endorsement Type | Description | Potential Benefits |

|---|---|---|

| Scheduled Personal Property | Provides extra coverage for valuable items like jewelry, art, or collectibles. | Ensures your valuable possessions are fully protected, with higher coverage limits. |

| Home Business Coverage | Covers liability, equipment, and other risks of running a business from home. | Protects your business assets and helps reduce liability concerns. |

| Water Backup and Sump Pump Overflow | Protects against water damage from sewer or sump pump issues, often excluded from basic home insurance. | Offers coverage for a common and costly risk. |

| Earthquake Coverage | Covers damage to your home and belongings from earthquakes. | Ensures protection in areas prone to seismic activity. |

Adjusting how you think about insurance endorsements along with when to put for added strain on the policy can help in making your home insurance cover adequate. In this fashion, you receive the best insurance that meets your individual needs.

Coverage Options for Business-Homeowners Avatar

Most probably as a small business owner working from home you would require more follow-through although one’s resident policy can provide. Some business activities would need a home insurance cover but this is generally not satisfactory. Such insurance helps small business owners who work from home.

- Business equipment is a significant limitation. Most of the business assets in tact would only have minimal protection from the person’s homeowner’s policy. Such a loss would usually be better covered by specific business policies.

- Covers repair or replacement of business equipment, such as computers, printers, and specialized tools

- Protection against loss of or damage to finished goods, semi-finished products, and raw materials расположенные на территории предприятия.

- Loss of, or damage to, business documents and record.

One warranty that won’t hurt a home business owner is home business insurance. These would cover protection from legal suits or claims made against the business owner for negligent injuries, accidents, or destruction of property. This would be important for home-based business persons.

“Every business operations conducted from home needs proper insurance coverage otherwise one may in the end and be there literally starving due to the consequences of a catastrophe.”

For freelancers, consultants, or small-scale manufacturers who work at home, home based business insurance is worth the investment. It secures the enterprise as it expands and makes it more noticeable in the market.

The Impact of Your Location on Insurance Coverage of Businesses Operating from Home

Your home’s address greatly determines the insurance you are likely to take out. Aspects such as the nature of crime in your area, how far you are from a fire station, as well as the likelihood of natural disasters can all determine the type or the amount you are likely to pay for your policy.

For example, homes that are placed in terrific crime rate areas tend to spend more on security and liability coverage. All of these add up to raise the costs of your insurance. Additionally, residences that are far away from fire stations tend to have most of their insurance costs high as it takes time to reach there during an emergency. Besides, areas that are likely to experience tornados or earthquakes require above average coverage to protect the residence.

Your ZIP code plays an essential part in how insurance companies assess your risks. To determine your coverage and rates, they take into account historical claims data, zoning regulations, demographics, and many other factors that are relevant to your area. Understanding how different areas impact your insurance policies is a way to stay informed and reduce expenses.

FAQ

What are the general expectations of home owners insurance?

Home insurance indemnifies the personal property and the house structural coverage (dwelling coverage) of the policy holder. It also provides liability coverage where someone who gets injured on the policy holder’s property is compensated. It finances additional living expenses when covered home gets damaged to the extent that it is uninhabitable.

What are the various categories of home insurance?

There are several subclasses in home insurance: basic or HO-1, broad or HO-2, and special or HO-3. On the other hand, renters’ insurance policies can be classified as HO-4, comprehensive and HO-5 or condo owner insurance HO-6. HO-7 specializes in mobile homes and HO-8 suits houses built many years ago.

What is the difference between replacement cost and actual cash value coverage?

Replacement cost coverage allows for the purchase of similar quality new items while actual cash value coverage compensates for the worth of the item at present time.

What is liability coverage in home insurance?

If someone gets injured on your property and wishes to take you to court, liability coverage does assist too. Such costs include medical expenses and lawyer’s charge.

What is additional living expenses (ALE) coverage all about?

ALE coverage is used to help with the cost of temporary housing and meals in the event that a person’s home is seriously damaged and becomes uninhabitable.

Does home insurance cover natural disasters?

Most policies cover windstorms, hail and storms in winter. However, they do not cover floods and earthquakes or any other natural disasters. Additional policies may be required for those.

What is a home insurance endorsement?

Endorsement is described as an addition of extra coverage on your policy. It could cover things such as certain expensive possessions, home enterprises or extra liability. Endorsements enable you to modify your policy in accordance to your specifications.

How does the location of my home affect my insurance coverage and rates?

Where you reside will depend on how much your insurance coverage will cost. Other factors to consider include the level of crime, proximity to a fire station, and likelihood of natural disasters.