What is Short Term Disability Insurance?

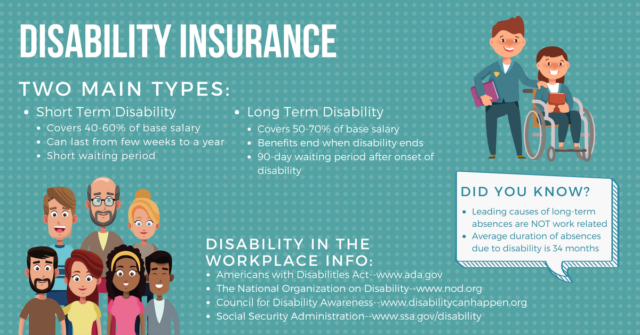

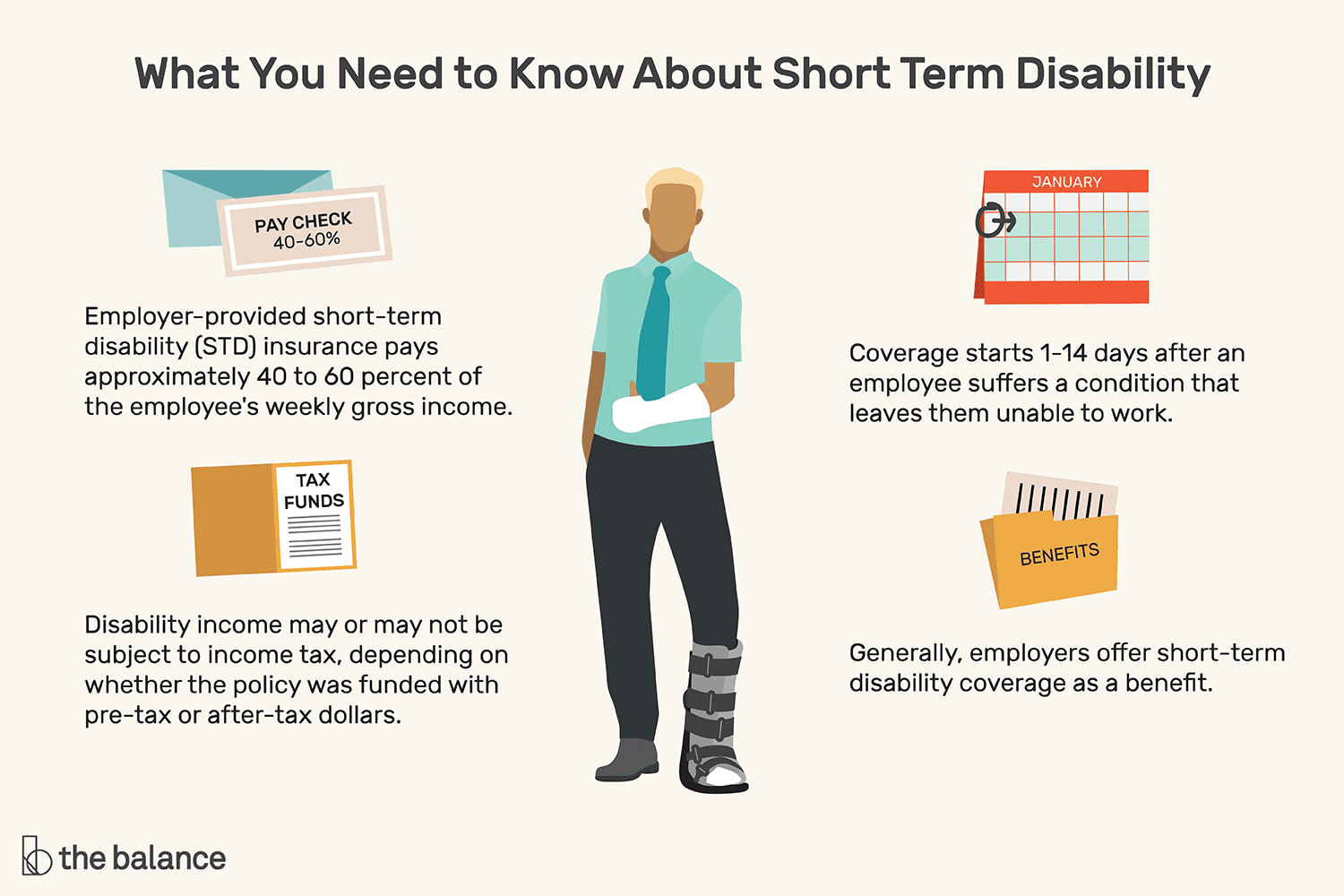

Short term disability insurance is intended to boost the income of the affected policyholder who, because of some short-term illness or injury, is unable to work. It usually encompasses:

- Duration: Ranges from 3 to 6 months, as determined by the specifics of the policy.

- Coverage: A specified percentage of the policyholder’s salary, which usually lies in the range between 50%-70% of the total amount.

- Eligibility: Such benefits are usually offered as part of employee benefits or can be bought individually.

Short-term disability insurance is appropriate for conditions such as convalescence after minor surgery, recovery from injuries or even maternity absence.

What is Long Term Disability Insurance?

Long term disability insurance is also aimed at giving income replacement to individuals who are ill for an extended period or who are permanently disabled. It encompasses:

- Duration: Commences once the STD benefits period has expired and can extend for several years or up to the age of retirement.

- Coverage: Provides a percentage of the patient’s income, normally 50%-60%.

- Eligibility: Usually offered through employing companies, or privately through providers.

This type of insurance is essential for the extremely severe medical illnesses such as cancer, chronic diseases, severe mental health disorders which will incapacitate one for an extended time.

Key Differences Between Short-Term and Long-Term Disability Insurance

| Feature | Short-Term Disability Insurance | Long-Term Disability Insurance |

|---|---|---|

| Duration of Benefits | 3 to 6 months | Several years or until retirement |

| Waiting Period | 0 to 14 days | 90 days or more |

| Coverage Amount | 50%-70% of salary | 50%-60% of salary |

| Cost | Generally lower | Higher premiums |

| Purpose | Temporary injuries or illnesses | Chronic or severe health conditions |

What is the Difference Between Short-Term and Long-Term Insurance?

Short term and long term are terms that are often heard, when used in disability insurance and other policies, the two actually mean different things:

Short-Term Insurance: Generally, short term insurance would include loss of earnings caused by business interruptions, eventuality or any risks which are likely to happen within a specified or a limited time. In terms of disability cover this would be covering temporary situations such as maternity leaves or minor injuries.

Long-Term Insurance: Such insurance covers for long term possibilities of risky situations and uncertainties. For disability insurance, this covers long term or life changing events which require long term or life long assistance.

Such a knowledge is crucial when buying a cover and wishing to utilize the benefits both now and in future time.

Short-Term vs. Long-Term Disability in Ontario

Short term , long term disability insurance Ontario, both these insurances are known in Ontario, especially in the workplace as benefits, hence understanding their particulars lets the employees utilize the most coverage:

Short Term Disability Insurance in Ontario

- Usually offered by the employers, as part of the group plan.

- It necessitates a maximum of seventeen weeks of leave as per the policy of the employer.

Some mix can include some or all of the sickness benefits under employment insurance. - Covers everthing except for taxes. Long-Term Disability Insurance in Ontario

- Able to pay out once the standard benefits become depleted.

- Covers most of the terminal illnesses or severe injuries such as failure which then leads to unrealized disability. Depending on the terms of the policy, it might be possible to extend coverage until the age of 65 or even longer.

What Qualifies for Short-Term Disability in Florida?

Florida’s qualification criteria for short-term disability differ based on individual providers but generally include:

- Medical Documentation: Proof of a medical condition that prevents work, verified by a licensed healthcare provider.

- Employment Status: Active employment or coverage through a purchased policy at the time of disability.

- Elimination Period: A waiting period, typically 7-14 days, before benefits commence.

- Policy Exclusions: Conditions like pre-existing illnesses or injuries caused by risky behaviors may not be covered.

Common qualifying events include surgeries, pregnancy complications, or short-term recovery from injuries.

The Touch and Impact of Business Insurance with Disability coverage

Disability coverage is commonly included in the business insurance as part of employment benefits offered to employees. Above all, employers who provide both STD and LTD plans are able to leverage on higher workforce productivity as well as attract and retain top talents in their organizations.

Assured Benefits of Disability Insurance Plans to Businesses

- Loyalty budgets – Offering disability coverage increases loyal employees and happens to decrease the turnover.

- Retention of employee- Guarding the business against production loss due to employee leaves.

- Legal issues- It is worth noting that some jurisdictions treat disability as an employment related insurance cover.

But still businesses have to conduct frequent audits on policies to avoid excessive cost versus employee satisfaction. Especially on the area how Disability Insurance fits in all of this how Disability Insurance fits within the scope of general Blossoms insurance FAQs & Guides

This is a common view of many people and often times, it is why many people utilize the complete insurance guides and insurance FAQs: how does disability insurance fit in with everything else:

- Health Insurance: This policy will take care of medical bills, but will not help receive an income while recovering.

- Life Insurance: This insurance helps beneficiaries in case of death. But does two things that are not linked with disability insurance since its payouts are only to policyholders while alive.

- Travel Insurance: Of course, some insurance policies allow this as part of the insurance such as coverage for injuries abroad, but this generally does not allow replacement of income in the long run.

In fact, well presented FAQs can help to cut through the confusions related to these issues and the various advantages of disability insurance that are provided well.

What About Medical Coverage Abroad?

Those who live or work abroad or travel frequently may be in need of medical coverage abroad. However, the first step is to know how it differs from domestic disability cover:

- Emergency Care: There is a high probability of covering an emergency medical expense from travel insurance policies, however, such policies do not provide income replacement.

- Chronic Conditions: Disability insurance promises lifelong income provision, medical coverage abroad is mostly for short terms.

Travel Insurance and Disability Insurance Combined: For in the travel insurance policy, its major objective is to cover risks associated with cancellation of a trip, or even loss of baggage, but some of them also have provisions that are optional to pest insurance and medical emergencies. This is how it differs:

| Feature | Travel Insurance | Disability Insurance |

|---|---|---|

| Primary Purpose | Trip protection and emergency care | Income replacement for disability |

| Duration | Policy duration of the trip | Coverage over months or years |

| Scope | Limited to travel-related incidents | Comprehensive, including chronic conditions |

Disability insurance needs to be sustained long-term, but when traveling frequently, travel insurance can be an addon.

Frequently Asked Questions

1. How does short-term and long-term disability differ?

3-6 months of disability coverage is provided under short-term cover whereas long term covers a duration of years or up to the time of retirement.

2. How does short-term insurance differ from long-term insurance?

Immediate temporary coverage is provided by short-term insurance, long term covers a longer period hence incurs more costs in premium.

3. What are STDs and LDs in Ontario?

STD includes short-term disabilities which compensate the recipient for up to 17 weeks while LTD covers longer period needs for severe and permanent disabilities.

4. What does short-term disability insurance cover in Florida?

Eligible conditions include proving that your medical condition restricts your work activities, being an active employee and being insured according to the policy conditions including waiting times and the list of exclusions.