Disability insurance is a means of ensuring your proper financial footing when life throws you off course and you are unable to work due to a specific illness or injury. It is critical to make an appropriate selection of the disability insurance policy in order to protect your earnings and standard of living. Nevertheless, this is not a walk in the park since there are several options available in the market. Such things will be handled in this comprehensive guide on everything that you should know about disability insurance, including what factors you should consider when choosing a suitable plan, the common types of disability insurance, and how it can be integrated into your other insurance coverage.

Disability Insurance: The Basics

There’s neither a valid document nor an image nor a sound which describes how a disabled person earns income, rather the answer is disability insurance which is issued to millions ensuring earning potential after a disabling, an injury or an illness. It can help sustain people through a depressive period without the need of exhausting their resources or being a burden to the families and friends to cover expenses. Two primary varieties of disability insurance exist: short term disability insurance (STD) and long-term disability insurance (LTD). Differentiating them is an important factor to make the appropriate policy for the requirements needed.

What Is Short-Term Disability Insurance?: Short Term Disability Insurance (STDI) on the other hand, provides coverage for a specified and brief period of time encompassing a few weeks and up to some months. It is intended to provide coverage for disabilities that render a person unable to engage in a paying occupation, but are expected to be short term. Short term disability insurance could be risked by the employers as a benefit however it can also be bought individually.

Such a condition gives those who fall under this category about sixty to eighty persent of their income and after a specified grace period which is between seven to fourteen days, starts to give out benefits. Deeply beneficial to those who want to cover scenarios that include temporary health conditions such as recovery from surgery, pregnancy or suffering through a minor accident, this policy is quite useful.

What Is Long-Term Disability Insurance?: This Insurance encompasses a wider policy to cover the risk and thus provides payments ranging from several years up until either the maturity of the policy holder OR when they are able to return to work again. This insurance is vital in supporting individuals with permanent disabilities as it includes permanent disabilities that prevents income generating activities.

Long-term disability policies, unlike short-term disability insurance, impose longer waiting periods that range from 30 days to 180. After this elimination period is over, the policyholder will receive benefits for a limited duration for example two, five or even ten years, depending on what the policy stipulates.

Consider These Important Aspects When Deciding on Disability Insurance for Yourself

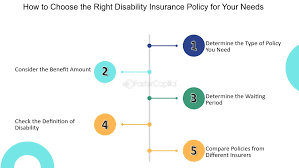

In order to make a good choice regarding a disability insurance plan, some of the key aspects that must be taken into consideration include:

1. The amount of coverage: While evaluating the disability insurance policy, the amount of coverage stands out as one of the most critical factors. If you do need to take up disability insurance, it is vital that the compensation is between 60-80% of the salary and time that you were employed before the incident occurred so that one can continue to live comfortably. It is important to remember that most policies do not insure 100 percent of one’s income since such a policy would discourage one from returning to work.

2. Waiting or Elimination Period: The elimination period of a Certain Benefit Plan is the total waiting period between the date of becoming disabled and the date when benefits are earned by the insured. This waiting time varies and could even be a few days or a number of months depending on the insurance policy chosen. A shorter elimination period means people will be availing the benefits of insurance within the minimum time possible but the premiums would be relatively high. While longer elimination periods generally provide lower premiums. The waiting period has to be in accordance with the financial situation of the individual insured.

3. Benefit Period: The benefit period is the duration for which disability insurance would grant benefits to the insured person once the waiting period is completed. For short term disability, which can last for a few weeks up to a few months, it would be around this time. However, for a long term disability, there can be coverage for a number of years until the person attains retirement age. People of old age or anticipating long term disability are benefitted in this approach as it has a longer benefit period.

4. Understanding what disability means.: As is the case with most types of policies, each has a different definition on what should be regarded as a disability. In some circumstances, certain policies may solely define disability as an inability to carry out one’s given employment, while others may state that it is an incapacity to conduct any job. It is important to examine this clause with great care since it is the policy’s purpose in the event of an accident or an illness.

5. Riders and additional benefits: Liberalization’s enhancement of the disability insurance policy may involve some optional additional riders that payment of an additional premium may allow. Some of the riders are;

- Cost-of-living adjustments (COLA): Benefits are adjusted periodically in order to prevent loss of purchasing power as a result of inflation.

- Own-occupation rider: This rider applies in the instance when the policyholder is unable to do their specified occupation but is able to do some other work.

- Future increase option (FIO): It allows the insured person to multiply his coverage as their income levels go higher, without the need for going through further medical underwriting processes.

How Disability Insurance Goes Hand In Hand With Your Insurance

The importance of disability insurance in one’s insurance and financial plan cannot be emphasized enough. It helps avoid loss-of-income situations due to a disability, and when combined with life, business or health insurance, it is even more effective when it’s most needed.

- Business Insurance: Business owners can also include a key person insurance and business overhead expense policy under their business insurance umbrella and these coverages are essential when a business owner sustains disability as they enable the business to work as normal even in the absence of the owner.

- Medical Coverage Abroad: For those whose work or fun entails a lot of traveling, travel medical insurance or international health insurance can cover for any expenses that you might incur when you are outside your home country. This works well with your disability insurance by covering unanticipated health concerns while traveling.

- Travel Insurance: Cover any risks that you might encounter while traveling such as falling sick, cancelling trips, lost baggage and so on. If for example you fall sick during a trip and cannot work, then this insurance can be used as an add-on to your disability insurance.

Common Disability Insurance FAQs.

A certain level of confusion may arise from individuals who have questions regarding the available policies. A few of these queries are addressed below:

What are the two most common types of disability insurance?: There are two common forms of disability insurance which include short-term disability insurance (STD) and long-term disability insurance (LTD). Short term disability is related to temporary disabilities and pays for a few weeks or several months while long term disability insurance pays for evergreen policies that may last for years or even till a retiree age.

Which situation would most likely use disability insurance?: Disability insurance can be invoked in cases where a person suffers some illness or injury and is unable to earn for a particular duration. This covers cases such as accidents, orthopedic surgeries, chronic diseases like arthritis, or even mental illness such as depression which reduces the individual’s functionality in a workplace environment.

What is the elimination period of an individual disability policy?: The elimination period is also known as the waiting period and it is the time that is elapsed before the first benefit is paid for the policy. This waiting period has a great impact on the policies globally and clients may have different waiting periods estimating from several days to several months. This is known to be the case depending on the needs of an individual.

Conclusion: Picking the Best Option

In order to select a suitable disability insurance policy, risks associated with your health, occupation and income levels need to be taken into account. Absorbing information about the types of disability insurance, its most important components, such as limits of coverage and elimination periods as well as auxiliary benefits such as riders, will help to pick the plan covering the scope of needs. Introduction of disability insurance is beneficial regardless of whether a short term or a long-term coverage is needed as it helps in maintaining the healthy financial status of an individual or organization during the hard times.

Tables:

Table 1: Short-Term vs. Long-Term Disability Insurance Comparison

| Feature | Short-Term Disability | Long-Term Disability |

|---|---|---|

| Coverage Duration | Up to 6 months | Years or until retirement |

| Elimination Period | 7-14 days | 30-180 days |

| Premiums | Lower | Higher |

| Benefits Paid | 60-80% of income | 60-80% of income |

Table 2: Common Disability Insurance Riders

| Rider Type | Description | Benefit |

|---|---|---|

| Cost-of-Living Adjustment | Adjusts benefits for inflation | Keeps your benefits aligned with inflation |

| Own-Occupation Rider | Pays benefits if you can’t perform your specific job | Ideal for specialized professionals |

| Future Increase Option | Allows policy increases without medical underwriting | Provides flexibility as income grows |

By understanding the different types of disability insurance and their benefits, you can make an informed choice that aligns with your needs and provides the security you deserve.