For many people, health insurance is an important asset that can help them cover a lot of medical costs when such a need presents itself. However, there are millions of people that do not fully utilize their health insurance plans. It does not matter whether it is an individual plan or a family or business plan; utilization of maximum benefits ensures maximum value of returns for the effort or money that has been put in. We will examine practical strategies to make the most of health insurance in this guide.

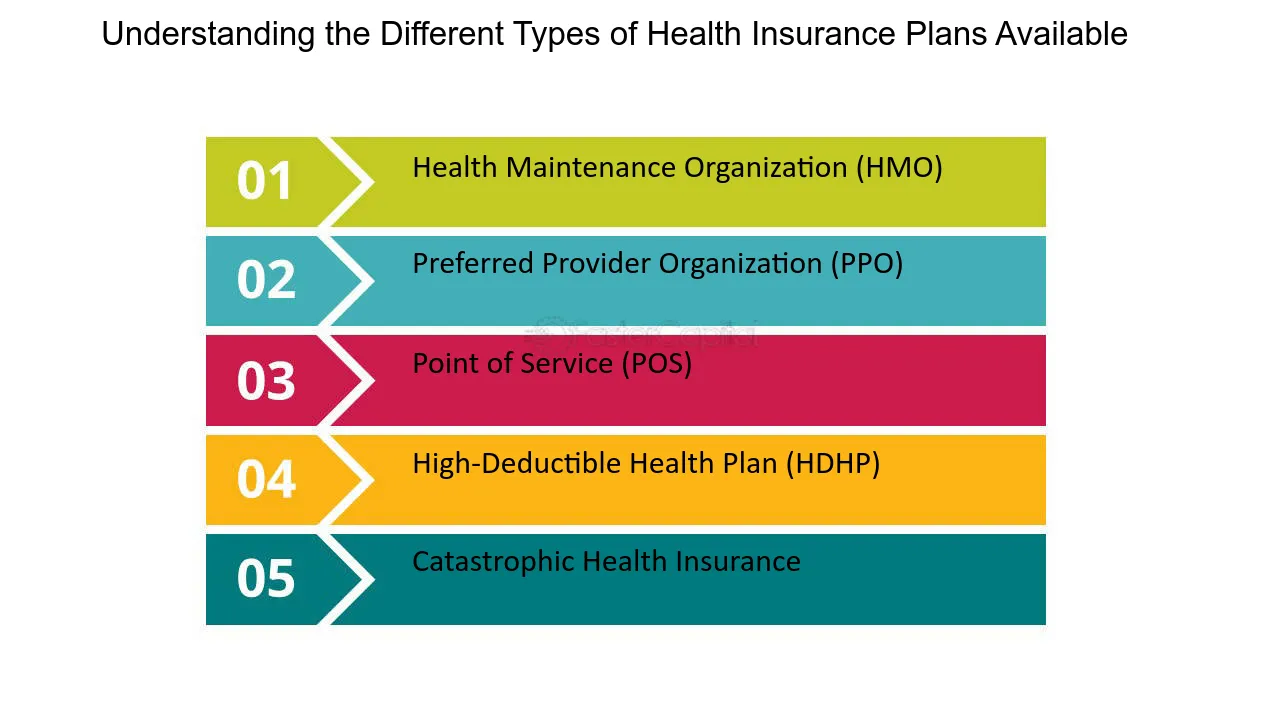

Health Insurance Plan Basics

In the section entitled guides for utilizing these benefits, we will introduce a number of useful tips on how to maximize benefits. But first, it is critical to understand some basic characteristics about the most health insurance plans.

Research Areas

Coverage Description: understand the services covered, including but not limited to preventative visits, hospital stays and specialist appointments.

Maximum Out of Pocket Spending: The amount you will spend in the year out of your own pocket that must be spent before the insurance company can cover all other future spending.

Deductibles and Co-Pays: The fixed amount that one must first pay before benefits apply and the standard price that must be paid for select treatments.

Network: Understand the positions of in network and out of network providers and their rates as they differ a lot.

Maximizing the Benefits of Health Insurance Plans

1. Have Health Screenings At least Once A Year: Most health insurance firms provide coverage for preventative checkups or screenings at no extra charge. These expenditures are also beneficial in detecting probable ailments even before they become too costly to treat.

2. Take Advantage of Out-of-Pocket Maximum: If you expect to have a more or less predictable amount of medical bills, you could utilize your out-of-pocket maximum while planning for expenses. This form of out-of-pocket expense is usually capped at a maximum limit which means once it is met, the insurer will pay for anything eligible for the remaining policy year.

3. Do Not Go Outside Your Network: Dealing with in-network providers means very few to no additional costs that have not been previously arranged. Out-of-Network services are less commonly covered or come at a hide price so check up a provider’s network status before calling for an appointment.

4. Consider Using Telemedicine: More and more patients are now opting for telemedicine for their routine follow-up needs. Many policies regarding medical insurance now allow online consultations as one of the components of treatment for ailments that does not require attending to on an emergency basis.

5. Choose Generic Drugs Over the Counter Drugs.: For those that take a prescription for drugs, it is always safer to first inquire from the attending physician whether there are generic substitutes available. Usually, generic drugs are hundreds of times cheaper than the actual branded ones but are as useful.

Use Your Wellness Programs Wisely More and more insurance providers are offering wellness incentives like gym memberships, programs for weight loss or against smoking. Utilizing the benefits is thus beneficial as it encourages a healthier lifestyle and is economically beneficial in the long run as it reduces costs associated with healthcare.

Generic vs. Brand-Name Medications:

| Factor | Generic Medications | Brand-Name Medications |

|---|---|---|

| Cost | Lower | Higher |

| Effectiveness | Same | Same |

| Insurance Coverage | Broadly Covered | May Require Pre-Approval |

7. Reassess and Revise Your Plan on a Yearly Basis: As life happens, it brings along new needs which require looking around for new coverage; for instance, getting married or changing jobs or having a baby. Such a review also during open enrollment periods helps in looking at the plan in relation to present needs and financial capability.

8. Keep Records and Seek Reimbursement of Medical Bills: Medical care encompasses a lot of expenditure hence one ought to maintain a record of their medical expenses including their bills, prescriptions, as well as any claims lodged to their insurances. Such documentation is useful in substantiating, correcting, and executing lawful tax deductibles for applicable charges.

9. Know the Difference Between Urgent Care and Emergency Room: Understanding when it is appropriate to seek an urgent care facility as opposed to spinal emergency care can be beneficial in saving a great amount of money. Minor injuries and illnesses are perfectly appropriate for urgent care clinics whilst life threatening conditions should be treated at the emergency rooms.

Emergency Room vs. Urgent Care:

| Factor | Emergency Room (ER) | Urgent Care |

|---|---|---|

| Cost | High | Moderate |

| Wait Time | Longer | Shorter |

| Ideal For | Severe Injuries, Emergencies | Minor Illnesses, Injuries |

Make use of a Health Savings Account (HSA) or Flexible Spending Account (FSA)

The funds accumulated in an FSA or HSA can be tax-free and can be used for medical costs in the future because they are established to save money on tax liabilities. The treatment of qualified expenses is broad in scope ranging from doctor visits to the purchase of medication.

Common Questions about Utilizing Health Insurance Coverage

1. What benefits are offered?

Benefits such as medical care that can include a set of services inclusive of promotional care and specialist care, staying in hospitals or even taking prescription drugs. These benefits differ among plans and insurers.

2. What is the best way to leverage an out-of-pocket maximum?

Major medical procedures or treatments can be done after the out-of-pocket maximum for a given year is reached. This guarantees that all other expenses will be reimbursed by your insurance company.

3. Which health screening tests should I pay attention to?

Some common tests conducted are blood pressure, cholesterol, diabetes, and cancer screenings among others. Ask your physician which screens would be the best for you considering your age and medical history.

4. Is it possible to reduce costs by changing insurance plans?

Definitely. Make sure that whenever open enrollment occurs, you do not simply enroll into any plan instead assess and make comparisons then choose one that is more appropriate.

5. How can a patient who has insurance go about having a telemedicine appointment?

People who have telemedicine appointments may expect similar costs and benefits as if they went in for an actual appointment. However, specific details may differ. It may be wise to speak with the provider in order to understand the plan better.

Conclusion

Enrolling yourself for various services is not sufficient, much effort is required in terms of having a clear understanding of the coverage, documenting everything and making choices about treatment about oneself with confidence. Following the strategies will assist in cutting costs, health goals and confidence the correct policies are in place. The correct approach will assist patients to utilize the numerous services of their insurance plans assuring them that they have covered all types of healthcare that they may need at any time.